When it comes to establishing the value of an estate, there are several key factors to consider. First and foremost, it is important to understand what exactly constitutes an estate. In simple terms, an estate refers to the total sum of a person's assets, including property, investments, personal belongings, and any other valuable possessions. The gross value of an estate refers to the total value before deductions such as mortgages, funeral costs, or debts. Whereas the net value refers to the total gross value of an estate minus liabilities before any taxes have been applied.

The responsibility of managing and valuing an estate typically falls on the executor or administrator of the deceased person's will. This individual is tasked with ensuring that all assets are properly accounted for and valued accurately. It is imperative that these valuations are conducted as soon as possible because if any inheritance tax is payable, it will be due six months after a death. It can take a significant amount of time to identify and assess the value of an entire estate, therefore it is best not to delay this process.

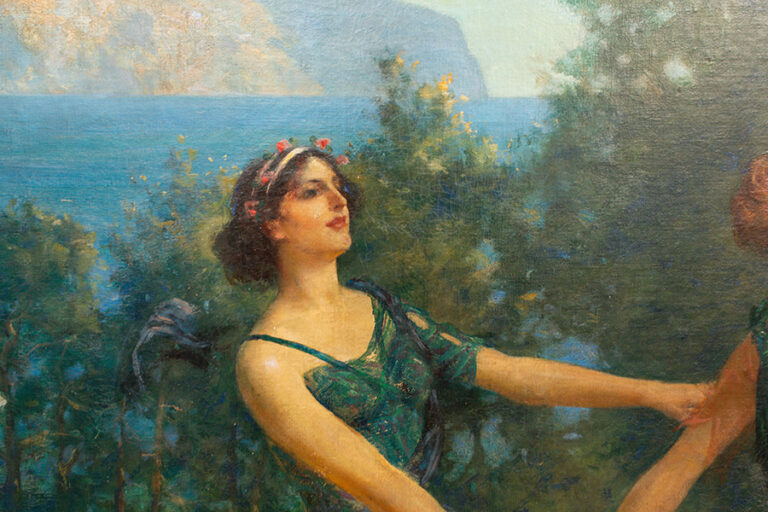

To determine the value of an estate, a thorough inventory must be conducted. This involves identifying and documenting all assets owned by the deceased at the time of their passing, including any lifetime gifts, which refers to cash or assets gifted to someone while the deceased was still alive – but limited to within 7 years of their passing, as well as any outstanding debts. It may be necessary to engage expert valuers who specialise in assessing specific types of assets within a property, including jewellery, artwork, or antiques. If any assets have accrued in value since the death, accurate valuations will need to be provided to calculate any Capital Gains Tax.

The value of an estate is required to make an application of probate, which will be submitted to Her Majesty's Revenue and Customs (HMRC) who will assess the value and determine if an estate is liable for any tax. They have guidelines in place to ensure that estates are valued correctly, and any applicable inheritance tax is paid accordingly.

Every estate in the UK has a tax-free allowance, which is currently set at £325,000 by HMRC. An estate over this value could be liable for inheritance tax. Estates could be eligible for an additional £175,000 tax free allowance if the property is passed down to children or grandchildren. There are also several other exemptions that could apply depending on what is in the estate and who is inheriting it.

Overall, establishing the value of an estate requires careful consideration and attention to detail. By working with expert valuers when necessary and following HMRC guidelines, executors can ensure that they accurately assess the worth of an estate as well as settle any debts before distributing its assets according to the wishes outlined in the will.

Dawsons are internationally renowned valuers & auctioneers. We provide our clients with detailed probate valuations to meet HMRC requirements and can facilitate the sale of valuables to an international marketplace, as required. Indeed, if you are dealing with an estate that may include valuable artwork, jewellery, antique or contemporary furniture, decorative art, silver, or collectables our expert team are here to help you.