When seeking a valuation, it is critical to note the purpose of valuation, as there is a big difference between a valuation for Probate and a valuation for Insurance purposes.

Probate Valuation:

Probate valuation is required when an individual passes away, to determine the value of their assets including money, stocks, shares, property, and personal possessions, against any outstanding debt, which will ultimately be used to calculate how much inheritance tax will be liable to the HM Revenue & Customs.

To ensure this figure is fair and accurate, a valuation of chattels will be determined based on a realistic market value at the time of death. Put simply, the value should reflect what you could sell the item for, on the open market, quickly and without travelling too far.

When it comes to antiques, collectables, jewellery, watches and artworks, several considerations affect this valuation including condition, rarity, provenance, comparative recent sale results, and fluctuating market trends. This is a real, obtainable value (lower than an insurance value), which is in the best interest of the estate as HMRC will calculate the estate tax according to the valuation provided for probate purposes.

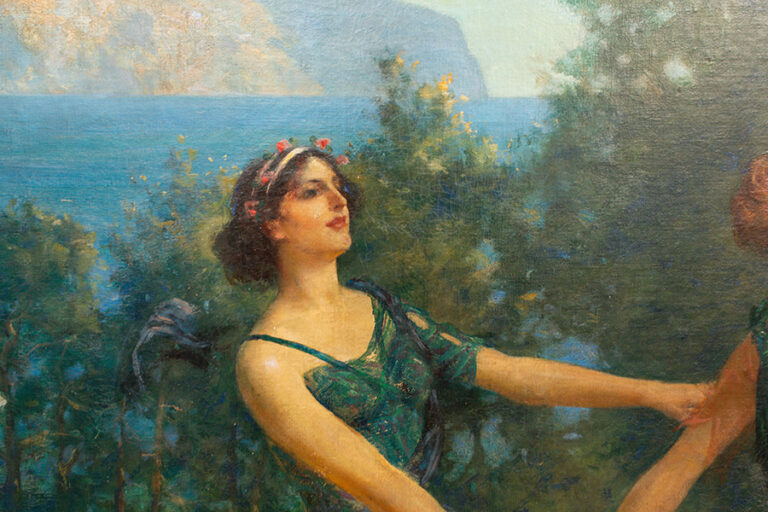

When deciding which independent professional valuation service to utilise, it is important to establish that they can provide a formal detailed document; listing, describing, and illustrating each item with the corresponding value, and including a final summary and inheritance tax valuation certificate which is suitable for submitting directly to the Probate authorities.

Insurance Valuation:

An insurance valuation determines the cost of replacing an item, either with a similar or new example, which will be based on retail prices. Possessing a detailed record of your valued assets ensures that you can disclose accurate and up to date information to your providers, so in the unfortunate event of needing to make a claim, you have peace of mind that you are fully protected.

Fluctuating market conditions can cause this value to rise and fall over time, so it is necessary to have this reviewed regularly to ensure you have adequate cover and/or that you are not paying too much. In the event of being underinsured, the amount paid out by the insurance provider will not be enough to replace what has been lost, alternatively, if your items have been overvalued, a claim might be disputed.

This type of valuation is not suitable for use in probate, as prices are determined by retail – which will include mark ups, restoration charges, overheads – all of which will result in a grossly overstated inheritance, and therefore a much larger, unnecessary bill to the HMRC.

In closing, a Probate valuation is “what the item is worth” and an Insurance valuation is “the cost of replacing the item”. If you were to inherit a painting with an Insurance valuation of £50,000 – but realistically you could only sell that painting for £10,000, which figure would be the one you use to declare your Inheritance? The lower, realistic one of course!